April 22, 2011

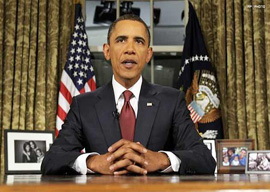

Barack Obama

He is today upside-down in every national poll. Many more Americans disapprove of the job he is doing than approve. Why would a president who has lost the support of half his country surrender a strong position that three-fourths of his country agrees with?

Democratic allies on Capitol Hill would regard this as madness.

What of the Republicans who appear today to be on the wrong side of the deficit reduction debate? Will they look at these polls and say, “We must stop trying to reform Medicare and Medicaid and move closer to Obama and impose higher taxes on successful Americans”?

To ask the question is to answer it.

Should Republicans revert to their venerable role of pre-Reagan days—the tax collectors for the welfare state—what would be the argument left for the existence of the party?

Not only does S&P’s grim assessment of the prospects for U.S. deficit reduction seem sound. News from across the pond points to a fast-approaching day of reckoning in the financial world.

European investors are now demanding and getting 22 percent interest on two-year Greek bonds. And with Greek debt at 150 percent of its gross domestic product—the same as Zimbabwe—the question is no longer whether Athens will default, but when, how and what will be the losses to European citizens, banks and governments who hold Greek paper.

Will Greece be the only domino to fall, or will Ireland and Portugal follow and the contagion spread across Europe and leap the Atlantic?

What makes this appear more imminent was the triumph this week of a Euro-skeptic and ethnonationalist party, the True Finns, which vaulted from five seats in the Helsinki Parliament to 38 and will almost surely be in the new government.

High on the True Finns’ agenda: tougher terms for any bailout of Portugal and using Finland’s EU veto to kill Angela Merkel’s plan for a super-bailout fund after 2013. Like other northern Europeans and even Germans in Merkel’s party, the stolid Finns are sick of subsidizing the self-indulgent deadbeats of Club Med.

And here is where the risk to Obama comes. Playing off Ryan may be smart short-term politics, but if the world financial system were to come crashing down—in part because of the absence of a U.S. deficit deal—no one would blame Paul Ryan.

The Herbert Hoover of that depression would be Barack Obama.